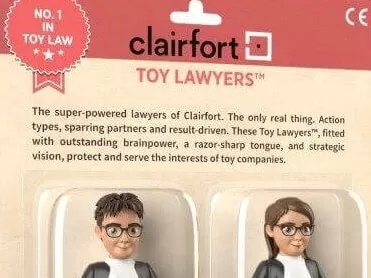

Krijn Keukens is a Clairfort partner and a lawyer specialising in Company law and Mergers & Acquisitions.

Before this he worked in medium-sized to large law firms and served as senior legal counsel to Endemol Shine for many years.

Krijn is a specialist in the field of mergers, acquisitions, management buy-outs and private equity transactions. In addition, he is involved in the provision of company law advice. Krijn has extensive experience overseeing national and international transactions in various sectors.

He provides advice to both buyers and sellers. He is particularly interested in transactions involving private equity parties “coming on board” family businesses. Because Krijn is intimately familiar with both worlds, he is well-placed to make the contacts that are usually required for this type of transaction.

Krijn’s approach is facilitative with the aim of achieving the best possible outcome for his clients quickly and effectively.